Business Has Been Good. But Don’t Forget About Checking Their Credit.

When business is rolling along and you are busy selling and shipping, it’s easy to forget about checking your customer’s credit. If you are selling closeouts and liquidating inventory it may feel like there is good demand that isn’t going away. Pull orders, ship, get paid in 3- to 60 days, repeat. All is good until it isn’t. An increase in gas prices, inflation fears, or even a downturn in the general economy can quickly be enough to jeopardize the health of your customers finances.

This is why it’s so important to check credit even when things are good. In fact, especially while things are good. Companies that buy closeouts and other overstock buyers liquidating inventory are generally in strong cash positions and have healthy reserves, but you just never know for sure. Closeout websites that cater to people selling closeouts need to keep up their guard, and be vigilant about requesting prepayment from new customers. There will always be new vendors needing to sell unwanted inventory, and they will always post on these closeout websites. The safest bet is to insist on payment in advance.

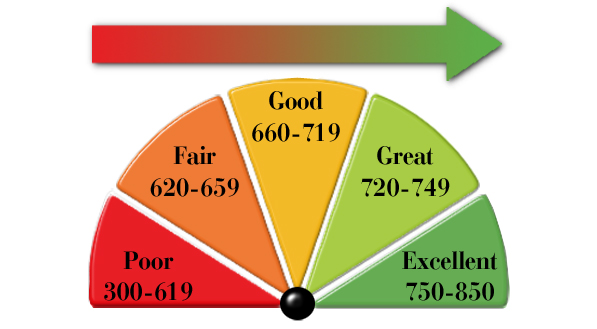

There are many mid tier credit companies you can sign up with to run fast credit checks. You may not be able to get all the special details you might want, but you can get a basic credit report with details on years in business, high credit, average time to pay, and other basic needs. This should cost around $2,500 for the entire year. It is a helpful tool if you are selling closeouts and liquidating inventory and you want to be paid quickly and without any headaches. As a general rule, overstock buyers who run sizable closeout companies are good credit risks and they pay very well. You can find a list of these kinds of surplus buyers by searching closeout websites or just google “selling excess inventory”, “closeout companies” or “buyers of discontinued inventory” or “overstock buyers”.

The last thing you want is to do all the hard work of getting merchandise, finding customers, pulling orders, packing and shipping, only to find out you aren’t getting paid. In our current business environment most of the accounts seem to be doing well. But as mentioned earlier, it won’t take much to shake things up and rock that boat. Whether you are selling closeouts, selling unwanted inventory, dealing with closeout buyers who have brick and mortar stores or advertising on closeout websites, be careful and stay on top of your customer’s credit.